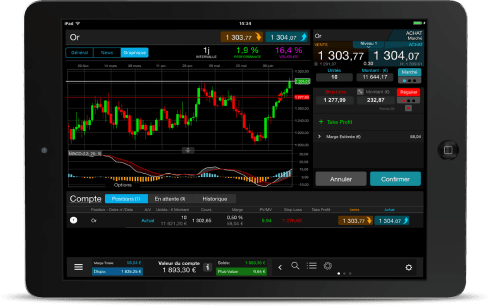

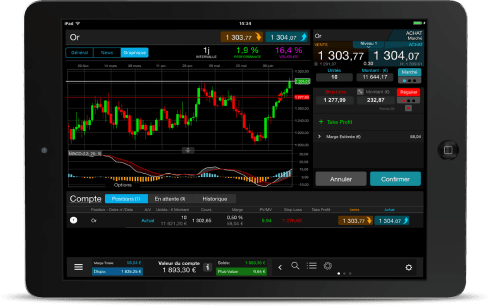

Explore our trading platform

Fully equipped with powerful tools, helping you reach the next level

- Trade Futures Contracts and Options Contracts

- Simple, convenient and intuitive UI

- Free access to Forex market research

Forex or FX is abbreviated from “Foreign Exchange” and stands for the trading of one currency against another. Forex is the most traded and liquid market in the world, it is 10 times larger than any stock market, and has a daily transaction volume of more than $5 trillion. Forex is usually traded OTC (over-the-counter), meaning there’s no centrally regulated exchange for it and the FX trading marketplace, which consists of Retail and Institutional investors, brokers, banks, and hedge funds, takes place on electronic platforms and via telephone between banks and the market participants.

With forex trading there’s no need to know which currency will rise or fall in general, but which currency will outperform the other on a specific trade. Trading and market react to both fundamentals and technical analysis, making forex a dynamic asset class.

Futures are financial contracts which require the buyer and seller to buy or sell an instrument at a predetermined future price (forward price) and date (expiration date). A futures contract is ideal for investors who are looking to speculate on the movement of currencies, indices and commodities or as a way to hedge against another trading position to prevent or offset unwanted losses.

Options contracts offers traders the opportunity to buy or sell an underlying asset at a predetermined price and expiration date. Unlike futures contracts, the holder of the contract does not need to buy or sell the asset if they choose not to.

A share is a company unit which represents a unity of ownership in a public company. The owner of shares in the company is a shareholder (or stockholder) of the corporation. The company occasionally pays dividends to the shareholders, and shareholders can trade with there shares to receive profit from the change of the face value.

Indices (plural form of “index”) is a portfolio of given stocks of an industry or market. Indices trading are a popular form of trading for retail investors to decrease the risk of stock market fluctuations and price volatility. Most well-known index is probably the NASDAQ.

Commodities are tradable goods like oil, gold or cocoa. In contrast to stocks, commodities doesn’t represent ownership of companies, but of raw goods. Commodities should meet the following criteria: have to be tradable, deliverable and liquid.

Fully equipped with powerful tools, helping you reach the next level