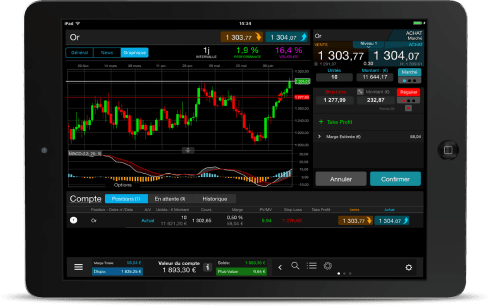

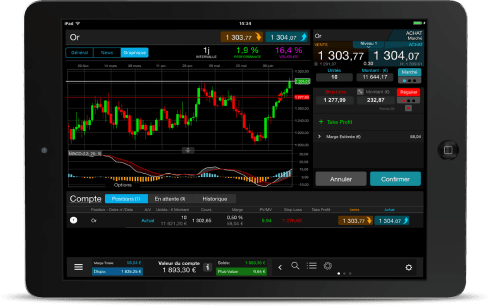

Explore our trading platform

Fully equipped with powerful tools, helping you reach the next level

- Trade Futures Contracts and Options Contracts

- Simple, convenient and intuitive UI

- Free access to Forex market research

A market order is a buy or sell order which is intended to be executed immediately at the current market prices. It is going to be filled as long as there are sellers and buyers on the market.

A pending order is an order for a future market price, which is intended to be executed at the time when the market price is equal to the pending order. It is not yet executed, thus not yet becoming a trade.

Types of pending orders available

Leverage is a multiplier of your trading deposit which allows you to open bigger positions. While leverage and margin trading have the potential to make bigger profits, they also inque a substantial risk for increased loss.

PIP (Point in Percentage), is a common Forex term which represents the smallest price move measure that a currency quote can have. For example, the smallest move the USD/CAD currency pair can make is $0.0001, or one basis point. Pips are the most fundamental unit of measure when trading currencies.

Spread is the price difference between the buying and the selling price. For example, if the EUR/USD is trading at 1.1467 buy price and 1.1465 sell price, then the spread is 2 pip.

A stop-loss order is an order to buy or sell an asset at the moment when it reaches a given price. Traders use it to manage risk on their positions, so the maximal loss is limited with the stop-loss order. The order becomes executed at the time when the price exceeds the given level.

Institutional

Institutional clients can access our state-of-the-art OTC solutions which provide extensive trading options for all needs. Global and regional liquidity sources help you to optimize your strategy and access all trading platforms you need. Contact our global sales department to discover all features and opportunities.

Retail

We believe in delivering value for both beginner traders and industry veterans. No matter the size of the position or the leverage used, we support your journey with letting you access a wide range of markets and asset classes on our user-friendly platform with advanced features and charting options.

Broker

Run your forex brokerage on a modular and scalable solution: our broker offerings enable your business to provide top notch trading experience to your clients from the back-office to the trading room. Fully modular, fully customizable - contact our sales team to get all your needs noticed.

Islamic account

Forex Islamic accounts are swap-free retail accounts to avoid the issue of Sharia Law prohibited lending practices on trading platforms. The Sharia Law forbids Muslim traders to lend money exclusively on the borrower’s risk, so Islamic accounts are not subjected to any swap fees or interest, which complies with the orders of Sharia law. Islamic accounts are also subject of overnight fees in a form of fix overnight fees after each open positions.

How to open an Islamic Trading Account?

Fully equipped with powerful tools, helping you reach the next level